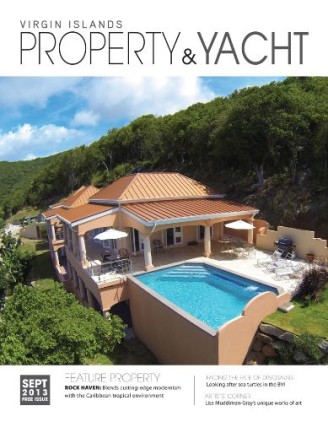

Featured Property

September 2016 brought devastation to the British Virgin Islands like many had never seen. Hurricanes Irma and Maria left a path of destruction and no island was spared. Tens of thousands of people lost everything, and it’s isolated location...

Read MoreYachting

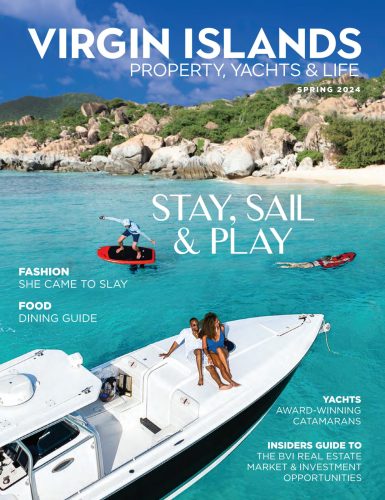

For almost 30 years VOYAGE Yachts have built beautiful, international award-winning yachts well known for their strength and quality craftsmanship. VOYAGE Charters is based in Sopers Hole Marina and incorporates the West End Boat Yard, owned and operated by...

Read More